Podcast Episode #2: Plant-based meats – Unpacking Consumer Insights

Did you know?

In 2020, 2.1 billion was the amount invested in plant-based meat, egg and dairy, according to the Good Food Institute. Moreover, an additional 1 billion came from full surveyed meats and fermentation…

Emily Yao

Skyrocketing investment in the plant-based meat market has been met with mixed sentiments. Some have high hopes for a more accessible and diversified category of products which would enable consumers to reduce their carbon footprint, preserve biodiversity, and support healthier and cruelty-free alternatives to animal-based protein sources. Yet alongside the growing attraction of diverse investors, with notable sums of money in the balance, many are rightfully questioning the increasingly complex, sometimes evasive priorities behind this market growth – and what it has to offer.

Whatever the case, we at Sight and Life, believe these disruptive questions deserve to be answered. Read on as we dig deeper into the key arguments made by expert panelists in our BrainFood podcast episode and blog, the second in our series on plant-based meat. If you’re just joining the conversation, check out our first episode and blog, ‘Plant-Based Meat: Getting the nutrition facts straight’ for an introduction to the nutrition facts of plant-based meats.

In this blog, you will find answers to the following questions:

- What does the future of the diverse proteins industry look like?

- How is global consumption of these products changing? What does this mean?

- How are companies marketing diverse proteins and what is driving consumers to buy them in the first place?

- What role have nutrition science and R&D play in the development of these products? And what potential do they hold for developing more nutritious options in the future?

Market growth and trends in plant-based meat

Over a single year, plant-based meat experienced a 45% increase in global sales, up from $962 million in 2019, to $1.4 billion in 2020. In fact, within the plant-based market, diverse proteins make up the second largest category of sales after plant-based milk (1). By 2025, the plant-based meat market is projected to reach $8.3 billion (2), supported by new brands and product innovations across various regions (3,4). Nick Cooney, our guest expert and founder of the venture capital firm of plant-based products, Lever VC, discussed these remarkable trends. Nick shares a unique perspective into the plant-based market and its growth in both high-income countries (HIC) and low- and middle- income countries (LMIC).

UBS bank did projections [of plant-based meat sales] for various parts of the world, including the Middle East Gulf region Asia Pacific, and Latin America. Depending on the region, you see really significant year-over-year growth numbers- anywhere between 15 – 40 percent.

Nick Cooney

Although the alternative protein industry is currently focused on HIC, markets in LMIC are increasingly being targeted, even in countries such as India, where meat consumption is currently low (5).

Globally, investments in diverse proteins rose to $3.1 billion in 2020, over tripling from the previous year (6). In the same year, analyses highlighted that R&D investment among three leading companies represent 0.5% to 7.7% of their total profits (7,8). However, there is still relatively little that is known about how investments in R&D and marketing are allocated. In this 2nd episode, Nick Cooney and Dr Hannah Theobald, Head of Nutrition at the pioneering food company, Quorn, share their knowledge on the various types of investments in plant-based meat within this sub-sector.

… [Within] the plant-based meat space, as a sub-sector, most of the investment […] and the use of proceeds of that investment is actually not on the R&D side. The large majority is other things that are just about general commercial growth.

Nick Cooney

In the past decades, growth in the plant-based market has been steady (9), resulting in the appearance of a wide range of food product innovations across the globe. But this discussion must also address several key questions – is all this money being used to address the most pressing concerns of consumers? And do we even know what consumers are looking for?

What are the drivers of consumption of plant-based meats?

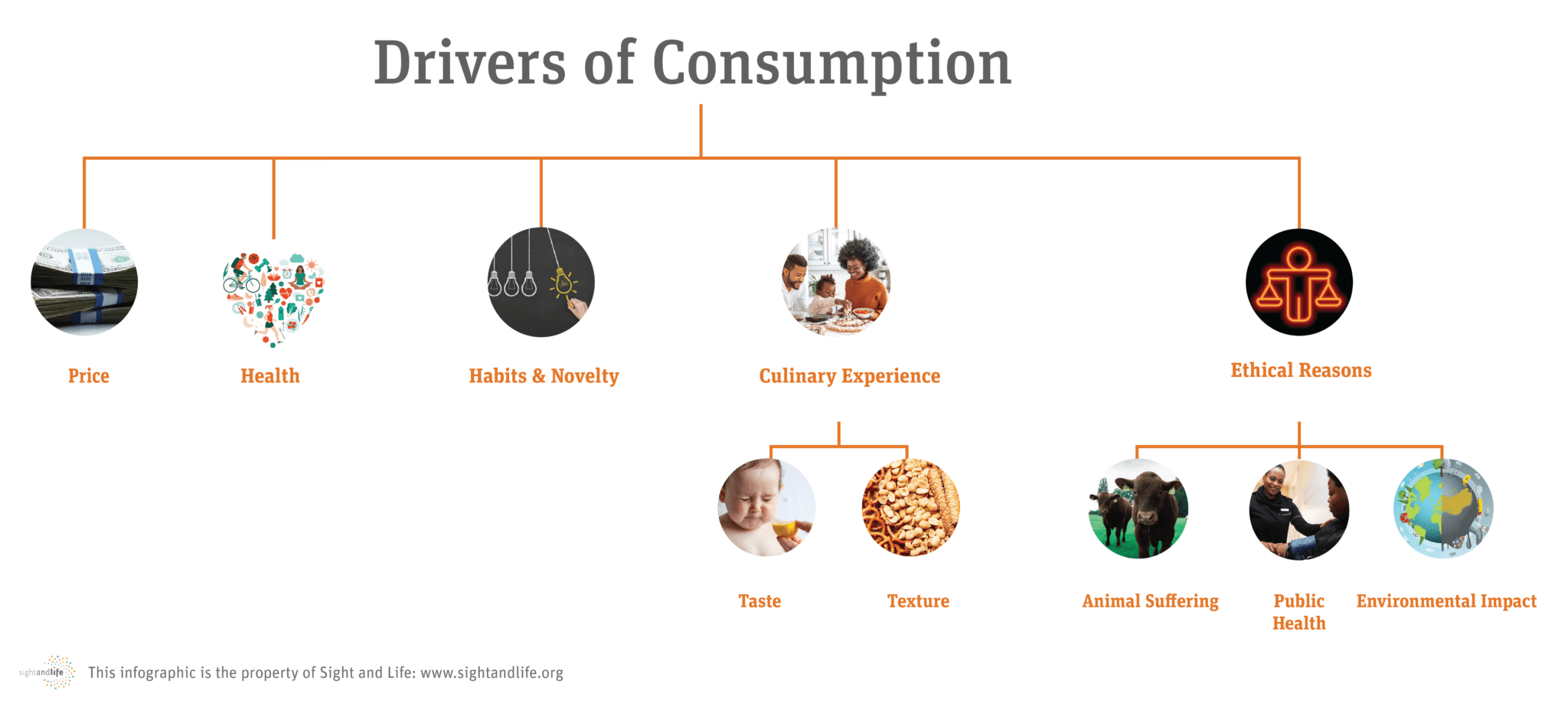

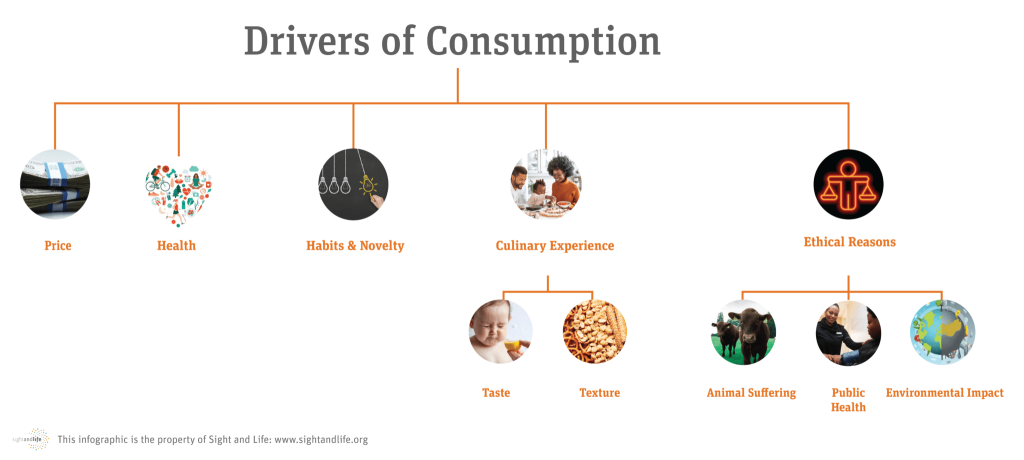

While drivers of consumption for the plant-based meats sub-sector are diverse, these drivers remain generally consistent for the different products within this category. It is important to note, however, that the prioritization of these key drivers differs slightly across regions. Take a look at Figure 1 for a breakdown of these key factors affecting plant-based meat consumption and follow the description of each driver throughout the blog.

[caption id="attachment_46291" align="alignnone" width="1024"] Figure 1. Drivers of plant-based meat consumption[/caption]

Figure 1. Drivers of plant-based meat consumption[/caption]

Experts, Nick Cooney, Dr Hannah Theobald and Dr Marleen Onwezen, Scientific Expertise Leader Consumer Behavior at Wageningen University & Research, share their views on these key drivers.

The biggest driver for food choices in the UK is definitely taste. It might be different elsewhere in the world. The second is price, and in third place, you will see nutrition or animal welfare coming in, followed behind by environmental sustainability.

Dr Hannah Theobald

It is well-known that price, taste and convenience are the top drivers of general food consumption (10). In the plant-based meat category however, price is one of the primary factors holding back growth of this sub-sector (11–14). Nick Cooney provides his perspective on how to drive down prices in this market. He argues that to offer consumers more competitive and affordable prices than conventional meat, producers, distributors, and retailers in the plant-based meat industry should reduce their profit margins across the food value chain.

Although the evidence of the nutritional benefits of plant-based meat products is still inconclusive (15,16) (as explained in the 1st blog of this series), health consciousness has been a major driver for the consumption of plant-based meat, as plant-based foods are often perceived as the healthier option (15). Nonetheless, plant-based meat companies are evolving; Dr Theobald explains how companies are putting great efforts into improving the nutritional profile of products. On the other hand, Nick Cooney emphasizes a continuing trend which has yet to be remedied: the lack of nutritionists in plant-based meat companies.

So, what we’re seeing is more companies putting nutrition front and center, considering fiber and protein once again, but also vitamins and minerals. And of course, looking at the sodium and saturated fat content.

Dr Hannah Theobald

I would say the number of companies that have a nutritionist on their staff, where the goal of that position is to make the product as nutritious as possible within the given parameters, is very rare.

Nick Cooney

Consumers’ dietary patterns and perceptions of protein sources are largely determined by context and culture. For example, a study in Norway reported that men perceived conventional meat as a necessary component of a “proper meal”(17). In LMIC, consumption of plant-based protein is higher than conventional meat (4,18). Dr Theobald speaks more to this and underlines the importance for plant-based products to be tailored to the country context and to match the local dietary and culinary patterns and preferences. In this 2nd episode, we delve further into worldwide nutrition and consumption patterns.

LMIC are still increasing meat consumption and are losing the heritage of these novel and sustainable proteins. This is risky, and it’s important to support LMIC to keep the status of plant-based products, the social norms, and the cultural consumption heritage to really keep that tradition alive.

Dr Marleen Onwezen

Habits and Novelty: Some consumers seek out innovative products and new food experiences, while others prefer to maintain their habits, preferring familiar flavors to new ones (15,19). Changing habits toward plant-based meat is key for sustained growth (15). However, in this 2nd episode, the behavioral science expert, Dr Onwezen, explains the complexity of changing behavior due to its subconscious nature.

Emotions, social norms, and the environment are really strong drivers that influence our behavior. That makes it also very difficult to change behavior because it’s not that much a conscious process. It’s also a very unconscious process. One of the mechanisms, which is very strong and also quite subconscious, is habits.

Dr Marleen Onwezen

Culinary Experience is another key driver of consumption, as consumers across the globe, have reported avoiding plant-based meat due to its unfamiliar texture and lack of flavor compared to conventional meat (19). To address this concern, various companies are investing in different technologies that promise great advances to enhance the texture, taste, and quality of plant-based meat. Nick Cooney emphasizes how investing in R&D for improved culinary experiences can provide a desirable return on investment to companies and investors.

Ethical Concerns: Evidence is mixed on how far consumers change their behaviors in response to ethical concerns (20–23). Only limited number of experimental studies have shown that people reduce meat consumption upon being taught about ethical concerns (24–26). However, if social norms change, many consumers are likely to follow suit (19).

Although we have all the available knowledge on what a healthy and more sustainable diet is, and that we really should reduce our meat consumption, for example, in the Netherlands, we see that it’s very, very difficult to really change behavior.

Dr Marleen Onwezen

Ethical concerns growing among consumers include animal suffering (27,28), environmental issues such as reducing greenhouse gas emissions (29), land usage/deforestation (30), and water usage (31). For instance, environmental impact and animal welfare represent 13% and 11% respectively among the drivers of consumption of plant-based products driven mainly by Millennials and Gen-Z consumers, according to the Plant-based Foods Association (32). However, years ago, those concerns were not as common among consumers; for example, a systematic review published in 2016 showed that consumer awareness of meat production’s impact on the environment, and their willingness to change behaviors around meat consumption, were surprisingly low among people in western countries (21). Finally, since the beginning of the Covid-19 pandemic, increased public health concerns have emerged on antibiotic resistance derived from meat consumption (33). Awareness of these diverse ethical concerns has risen in the last decade, with more extensive coverage in mainstream media (34).

In summary, as technology improves, most of these key drivers of plant-based meat consumption are likely to increase demand for such products, and all drivers may reinforce each other. For example, if the awareness of meat production and its impact on animal welfare and environment increase, the consumption of plant-based meat may increase and therefore, prices might get down. While many questions remain to be answered, each of our three guest experts agree on one point: if social norms and habits change, plant-based meat might become more commonly consumed. In this regard, media coverage and marketing have increased the social awareness of plant-based meat products and continue to influence food consumption decisions (35,36).

How can marketing and the media influence consumer behavior around plant-based meat?

There are several marketing strategies to influence consumers to buy food products. First, building brand awareness, loyalty, and offering promotions have been shown to increase the demand for products (37). Additionally, packaging plays an important role; for instance, the visual appearance, soft color, shape and product photos, reflecting the brand’s sustainability values in packaging, are more appealing to entice consumers to purchase them(38,39). Finally, personalized technologies such as social media campaigns have helped grow the market, cutting marketing costs and reaching a broader audience (40,41). As stated by Dr Onwezen, marketing and media coverage have been crucial to plant-based meat business growth, even though this trend is not always observable in consumer behavior.

What we see is a big, big paradox between, on the one hand, the attention by the press, the media, the policy, and on the other hand, the behavior change by consumers and the retail.

Dr Marleen Onwezen

In western countries, most of the evidence on consumer intentions and behavior to decrease meat consumption shows some effective tactics, such as increasing the visibility of vegetarian dishes in the food environment and educational courses on how to shop and cook vegetarian food (42). Here, the retailer plays a strategic role in implementing lifestyle campaigns at the point of sale, inviting ambassadors to show the consumer how to incorporate the products into peoples’ everyday lives, and putting new plant-based products on shelves (43).

It’s a really positive thing to locate diverse proteins alongside meat foods (in the supermarket) because it makes consumer choices a lot easier.

Dr Hannah Theobald

Shaping the future consumption of plant-based meat

In summary, companies in the plant-based industry face a massive challenge of expanding their consumer base and maintaining and satisfying their current one. While the category keeps growing, the specific mechanisms driving consumer behavior and habits remain unclear across the globe. We have seen that generally, the most significant aid to the growth of the alternative protein industry is investment in innovations, rolling out improved products with great taste and texture, and advertisement engagement across different channels. Last but not least, companies must also consider the nutritional profile and sustainability issues that our global food system is facing. Companies should therefore also develop marketing techniques that reflect their corporate values, and support sustainable food consumption, animal welfare, fair-trade, and consumer health and well-being.

Sign up here and be among the first to receive our next episode on plant-based meat and its environmental impact!

In this episode, we collaborated with Dr Simon Brown, a Postdoctoral Fellow in the Foundations of Mind at Johns Hopkins University (JHU), and Emily Yao, an undergraduate Materials Science and Engineering student also at JHU; both are actively involved in the Alternative Protein Project chapter at Johns Hopkins. We thank them along with Nick Cooney, Dr Hannah Theobald and Dr Marleen Onwezen for their time and expertise!

References:

- PBFA. 2020 Retail Sales Data Announcement [Internet]. Plant Based Foods Association. 2021 [cited 2021 Nov 3]. Available from: https://www.plantbasedfoods.org/2020-retail-sales-data-announcement/

- Markets and Markets Research Private Ltd. Plant-based Meat Market. Plant-based Meat Market by Source (Soy, Wheat, Pea, & Other Sources), Product (Burger Patties, Strips & Nuggets, Sausages, Meatballs, & Other Products), Type (Beef, Chicken, Pork, Fish, & Other Types), Process, and Region – Global Forecast to 2025 [Internet]. Markets and Markets Research Private Ltd. [cited 2021 Nov 19]. Available from: https://www.marketsandmarkets.com/Market-Reports/plant-based-meat-market-44922705.html

- Gateway S. Plant-based meat producers TiNDLE, Impossible land in the UAE in time for Expo2020 [Internet]. Salaam Gateway – Global Islamic Economy Gateway. [cited 2022 Apr 29]. Available from: https://www.salaamgateway.com/story/plant-based-meat-producers-tindle-impossible-land-in-the-uae-in-time-for-expo2020

- IPES food | REPORT | The Politics of Protein [Internet]. [cited 2022 Apr 29]. Available from: http://www.ipes-food.org/pages/politicsofprotein

- Why India is a priority for plant-based and clean meat innovation – The Good Food Institute [Internet]. 2018 [cited 2022 Apr 29]. Available from: https://gfi.org/blog/indian-markets-food-innovation/

- 2020 was a record year for investment in diverse proteins [Internet]. [cited 2021 Nov 19]. Available from: https://gfi.org/press/record-3-1-billion-invested-in-alt-proteins-in-2020-3x-the-capital-invested-in-2019/

- Beyond Meat Versus Peers In R&D Spending | Fundamental Data And Statistics For Stocks [Internet]. [cited 2022 May 12]. Available from: https://stockdividendscreener.com/packaged-foods/beyond-meat-vs-peers-in-research-and-development-expense/

- Microsmallcap.com. Food Companies Continue to Spend on R&D as Plant-Based Food Movement Rages On [Internet]. [cited 2022 May 12]. Available from: https://www.prnewswire.com/news-releases/food-companies-continue-to-spend-on-rd-as-plant-based-food-movement-rages-on-301197934.html

- Plant-based Foods Market to Hit $162 Billion in Next Decade, Projects Bloomberg Intelligence | Press. Bloomberg LP [Internet]. [cited 2021 Nov 19]; Available from: https://www.bloomberg.com/company/press/plant-based-foods-market-to-hit-162-billion-in-next-decade-projects-bloomberg-intelligence/

- Drewnowski A, Monsivais P. Chapter 10 – Taste, cost, convenience, and food choices. In: Marriott BP, Birt DF, Stallings VA, Yates AA, editors. Present Knowledge in Nutrition (Eleventh Edition) [Internet]. Academic Press; 2020 [cited 2022 Apr 27]. p. 185–200. Available from: https://www.sciencedirect.com/science/article/pii/B9780128184608000101

- Bryant C, Barnett J. Consumer acceptance of cultured meat: A systematic review. Meat Science. 2018 Sep 1;143:8–17.

- Fellet M. A Fresh Take on Fake Meat. ACS Cent Sci. 2015 Oct 28;1(7):347–9.

- Hoek AC, Luning PA, Weijzen P, Engels W, Kok FJ, de Graaf C. Replacement of meat by meat substitutes. A survey on person- and product-related factors in consumer acceptance. Appetite. 2011 Jun 1;56(3):662–73.

- Clark LF, Bogdan AM. The Role of Plant-Based Foods in Canadian Diets: A Survey Examining Food Choices, Motivations and Dietary Identity. Journal of Food Products Marketing. 2019 May 4;25(4):355–77.

- Aschemann-Witzel J, Gantriis RF, Fraga P, Perez-Cueto FJA. Plant-based food and protein trend from a business perspective: markets, consumers, and the challenges and opportunities in the future. Critical Reviews in Food Science and Nutrition. 2020 Jul 13;0(0):1–10.

- Tso R, Lim AJ, Forde CG. A Critical Appraisal of the Evidence Supporting Consumer Motivations for Diverse Proteins. Foods. 2020 Dec 23;10(1):E24.

- Austgulen MH, Skuland SE, Schjøll A, Alfnes F. Consumer Readiness to Reduce Meat Consumption for the Purpose of Environmental Sustainability: Insights from Norway. Sustainability. 2018 Sep;10(9):3058.

- van Vliet S, Burd NA, van Loon LJC. The Skeletal Muscle Anabolic Response to Plant- versus Animal-Based Protein Consumption. J Nutr. 2015 Sep;145(9):1981–91.

- Onwezen MC, Bouwman EP, Reinders MJ, Dagevos H. A systematic review on consumer acceptance of diverse proteins: Pulses, algae, insects, plant-based meat alternatives, and cultured meat. Appetite. 2021 Apr 1;159:105058.

- Onwezen MC, van der Weele CN. When indifference is ambivalence: Strategic ignorance about meat consumption. Food Quality and Preference. 2016 Sep 1;52:96–105.

- Hartmann C, Siegrist M. Consumer perception and behaviour regarding sustainable protein consumption: A systematic review. Trends in Food Science & Technology. 2017 Mar 1;61:11–25.

- Lin-Schilstra L, Fischer ARH. Consumer Moral Dilemma in the Choice of Animal-Friendly Meat Products. Sustainability. 2020 Jan;12(12):4844.

- Bryant CJ. We Can’t Keep Meating Like This: Attitudes towards Vegetarian and Vegan Diets in the United Kingdom. Sustainability. 2019 Jan;11(23):6844.

- Schwitzgebel E, Cokelet B, Singer P. Do ethics classes influence student behavior? Case study: Teaching the ethics of eating meat. Cognition. 2020 Oct 1;203:104397.

- Schwitzgebel E, Cokelet B, Singer P. Students Eat Less Meat After Studying Meat Ethics. Rev Philos Psychol. 2021 Nov 6;1–26.

- Jalil AJ, Tasoff J, Bustamante AV. Eating to save the planet: Evidence from a randomized controlled trial using individual-level food purchase data. Food Policy. 2020 Aug 1;95:101950.

- Clonan A, Wilson P, Swift JA, Leibovici DG, Holdsworth M. Red and processed meat consumption and purchasing behaviours and attitudes: impacts for human health, animal welfare and environmental sustainability. Public Health Nutrition. 2015 Sep;18(13):2446–56.

- Huemer M. Dialogues on Ethical Vegetarianism, Part 1.

- Scarborough P, Appleby PN, Mizdrak A, Briggs ADM, Travis RC, Bradbury KE, et al. Dietary greenhouse gas emissions of meat-eaters, fish-eaters, vegetarians and vegans in the UK. Climatic Change. 2014 Jul 1;125(2):179–92.

- Poore J, Nemecek T. Reducing food’s environmental impacts through producers and consumers. Science. 2018 Jun;360(6392):987–92.

- Mekonnen MM, Hoekstra AY. A Global Assessment of the Water Footprint of Farm Animal Products. Ecosystems. 2012 Apr 1;15(3):401–15.

- Consumer Insights [Internet]. Plant Based Foods Association. [cited 2022 May 12]. Available from: https://www.plantbasedfoods.org/marketplace/consumer-insights/

- Attwood S, Hajat C. How will the COVID-19 pandemic shape the future of meat consumption? Public Health Nutrition. 2020 Dec;23(17):3116–20.

- Painter J, Brennen JS, Kristiansen S. The coverage of cultured meat in the US and UK traditional media, 2013–2019: drivers, sources, and competing narratives. Climatic Change. 2020 Oct 1;162(4):2379–96.

- Martinho VJPD. Food Marketing as a Special Ingredient in Consumer Choices: The Main Insights from Existing Literature. Foods. 2020 Nov;9(11):1651.

- Janssen M, Busch C, Rödiger M, Hamm U. Motives of consumers following a vegan diet and their attitudes towards animal agriculture. Appetite. 2016 Oct 1;105:643–51.

- Joseph J, Sivakumaran B, Mathew S. Does Loyalty Matter? Impact of Brand Loyalty and Sales Promotion on Brand Equity. Journal of Promotion Management. 2020 Jun 6;26(4):524–43.

- Malešević M, Stančić M. Influence of packaging design parameters on customers’ decision-making process. Journal of graphic engineering and design. 2021 Dec 1;12:33–8.

- Bocken N, Morales LS, Lehner M. Sufficiency Business Strategies in the Food Industry—The Case of Oatly. Sustainability. 2020 Jan;12(3):824.

- Goh KY, Heng CS, Lin Z. Social Media Brand Community and Consumer Behavior: Quantifying the Relative Impact of User- and Marketer-Generated Content. Information Systems Research. 2013 Mar;24(1):88–107.

- Nicolai N, Bermoy B, Justine J, Guzman J, Guzman J, Kaye S, et al. Influence of Social Media as a Marketing Platforms for Food- related Products in the New Normal. International Journal of Multidisciplinary Studies. 2021 Jan 29;5:106–11.

- Kwasny T, Dobernig K, Riefler P. Towards reduced meat consumption: A systematic literature review of intervention effectiveness, 2001-2019. Appetite. 2022 Jan 1;168:105739.

- Gravely E, Fraser E. Transitions on the shopping floor: Investigating the role of Canadian supermarkets in alternative protein consumption. Appetite. 2018 Nov 1;130:146–56.

Read next

Discover more

News & announcements

Find out what is new at Sight and Life

Multimedia

Explore our videos, podcasts, and infographics