Diverse Proteins: What’s the deal?

What are diverse proteins, and why are we talking about them?

The global food system will need to feed 10 billion people by 2050 – including a nearly 75% increase in meat demand, driven mostly by low-and-middle-income emerging markets in the Global South[1]. Currently, the meat sector is a trillion-dollar market projected to increase by nearly 4% annually[2]. This tremendous growth in meat consumption poses significant resource challenges, and meeting this demand must occur in a holistically sustainable way. A promising alternative protein industry has recently emerged to address this challenge with products ranging from reconfigurations of the typical plant-based legumes into meat substitutes, like Impossible Burger, to using edible insects and introducing novel products such as lab-grown meat or single-cell proteins from algae, yeasts, or fungi. Compared to meat counterparts, diverse proteins’ projected positive impacts on climate and animal welfare and potential health benefits have piqued interest in this sector[3].

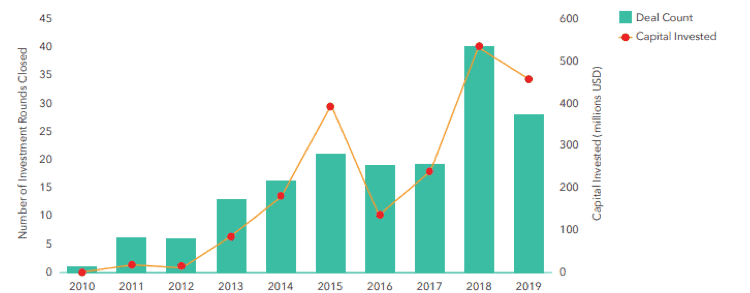

Investments in Plant-Based Food Companies (2010–2019)

The alternative protein industry can be segmented by protein source and level of processing: fortified or otherwise modified plant-base (including fungi and algae), insect-based, and lab-grown meat or by application: direct consumption, animal feed, and supplements. With a current market capitalization of $2.2 billion and concentrated in the Global North, most alternative protein startups and associated funding focused initially on segments with existing demand and potential growth opportunities like plant-based products. However, there is a rising favorable environment for alternative protein in the Global South due to increasing disposable incomes, consumer affinity towards sustainable consumption, less competition, and growing venture capital funding for startups. Furthermore, as European and American markets are becoming saturated with alternative protein products and more competitive, we anticipate these companies expanding their business model to the Global South. This plant-based movement has also spurred new developments such as the European Alliance for Plant-based Foods (EAPF), bringing together like-minded organizations in the plant-based value chain around a unique mission: To put plant-based foods at the heart of the transition towards more sustainable and healthy food systems.

At Sight and Life, we are working to advance innovations that need cross-sectoral expertise in nutrition, marketing, and business models in the Global South. We seek to pre-empt the movement of alternative protein into the Global South and identify priority focus areas as the industry shifts geographical focus. Two alternative protein segments relevant to these markets over the next five years are plant-based processed products and insect-based animal feed.

Why plant-based?

The plant-based category is the largest source of diverse proteins today. In 2019, plant-based companies in the U.S. raised nearly US$ 750 million, or 90% of the total funding for diverse proteins[4]. These companies are sustainable and significantly less resource-intensive than animal husbandry and their products, due to the dominant use of ingredients of soy and pea. Paired with environmental benefits, the ability to closely mimic a range of meat variants at a competitive price, plant-based meats are well-positioned to cater to the Global South. Moreover, multi-national food companies and protein producers, which have a presence in low-and middle-income countries, are investing in plant-based products.

Why insect-based animal feed?

The demand for animal source foods in the Global South is witnessing a sharp rise, with demand projected to increase by 73% by 2050. The market has seen a spike in input costs as traditional feed ingredients such as soy and fishmeal commodity prices rise. More and more farms are therefore demanding cheaper feed sources such as insects, as meat consumption increases. Though large-scale production of insect feed occurs in the Global North, there is an opportunity to scale existing small and medium enterprises in the Global South by adopting and innovating new technologies.

To meet the unique nutrition needs, the share of wallet and palate of the consumers, three areas that need attention are accessibility, awareness, and local taste preferences. Along these lines, Sight and Life will share insights in a three-part blog series on approaches that would make diverse proteins relevant for consumers in the Global South.

Making diverse proteins aspirational

Marketing a new product becomes critical in a new category, especially when consumers do not have any previous food product perceptions. In the next blog post, we investigate how alternative protein brands have established themselves and communicate with their consumers.Puja Peyden Tshering, Sight and Life’s consumer insights specialist, analyses four brands through an archetype lens, understanding the brand through a more human feel. Read the thought-provoking questions she raises as companies start speaking to consumers in the Global South in this blog post.

Diverse proteins through a nutritionist lens

With diverse proteins set to radically change our diets over the next few years, do we know if their nutritional value is as good as their substitutes, and whether they are appropriate for the Global South where the prevalence of malnutrition is high? Sight and Life’s nutritionists, Breda Gavin Smith, Kesso Gabrielle van Zutphen, and our interns Chiara Ferraboschi and Kris Woltering move beyond the headlines and provide a complete understanding of the entire alternative protein landscape and its impact on public health and nutrition in this interesting post.

Inclusive business models for diverse proteins

Diverse proteins currently cater to the premium segments, millennials, and Gen Z in the Global North, who enjoy a high spending power. But for diverse proteins to successfully cater to low-and-middle-income countries, affordability is a crucial lever. Sight and Life’s business model specialists, Kalpana Beesabathuni and Srujith Lingala, together with interns Hannah Wang and Emily Voorhies, identified market opportunities and viable business solutions that are sustainable and capable of producing protein alternatives to wrap up the series.

Stay tuned!

All graphics created by Sight and Life’s Architect and Design Specialist Anne Milan.

References

- Food Agriculture Organization (2011). World Livestock 2011: Livestock in Food Security. Rome: Food and Agriculture Organization. Accessed September 29, 2020. Available online via http://www.fao.org/docrep/014/i2373e/i2373e.pdf

- ReportLinker (2017). Opportunities in the Global Meat Sector: Analysis of Opportunities Offered by High Growth Economies. Accessed September 29, 2020. Available online via https://www.reportlinker.com/p04826928/?utm_source=PRN

- World Economic Forum.(2019). Meat: the Future series Diverse Proteins. Accessed September 29, 2020. Available online via http://www3.weforum.org/docs/WEF_White_Paper_Alternative_Proteins.pdf

- The Good Food Institute. (2019). U.S. State of the Industry Report Plant-based Meat, Eggs, and Dairy. Accessed September 29, 2020. Available online via https://www.gfi.org/files/soti/INN-PBMED-SOTIR-2020-0507.pdf

Read next

Discover more

News & announcements

Find out what is new at Sight and Life

Multimedia

Explore our videos, podcasts, and infographics